Steps to Register and Submit VAT return using ProboVAT

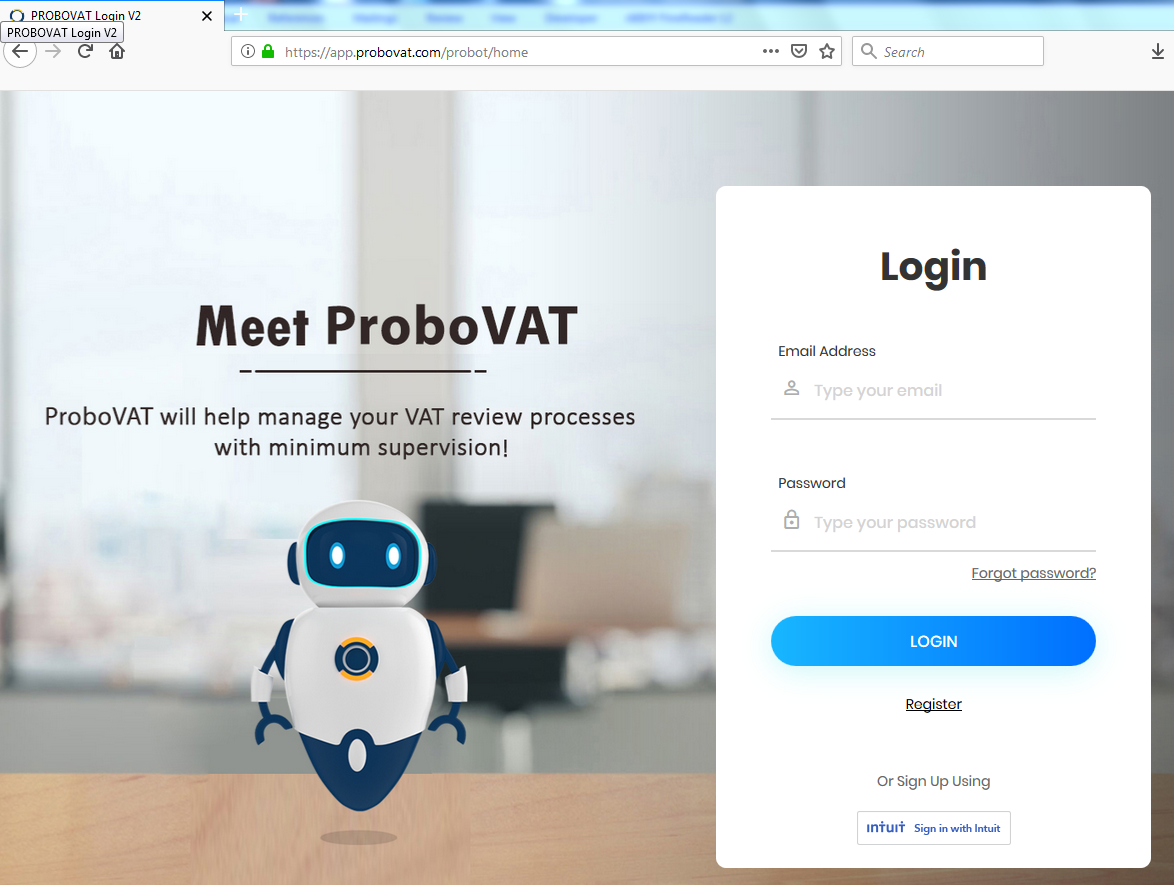

Step 1: Login to ProboVAT using “ProboVAT’s login credentials”. If you don’t have an Account in ProboVAT click on “Register” button on home screen and create an account.

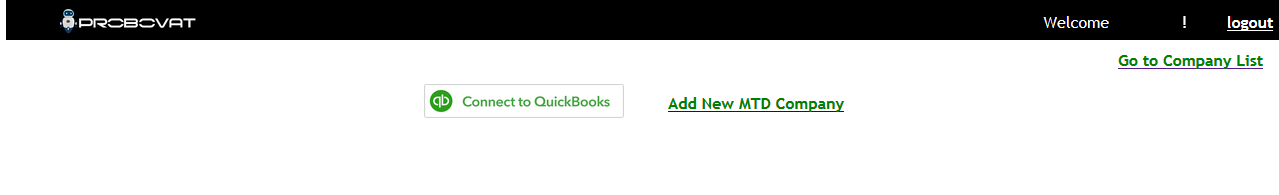

Step 2: Click on “Add New MTD Company” button

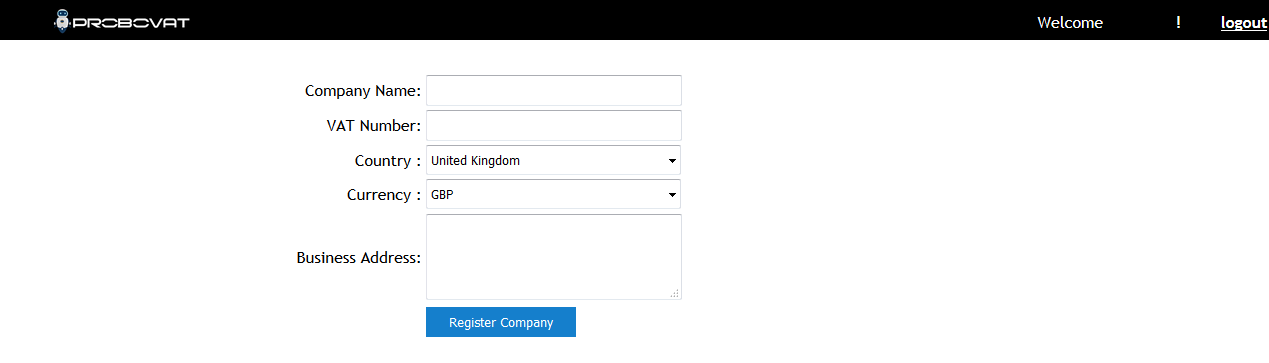

Step 3: Enter the Company Details such as Company Name, VAT Number, Business Address and click on “Register Company”

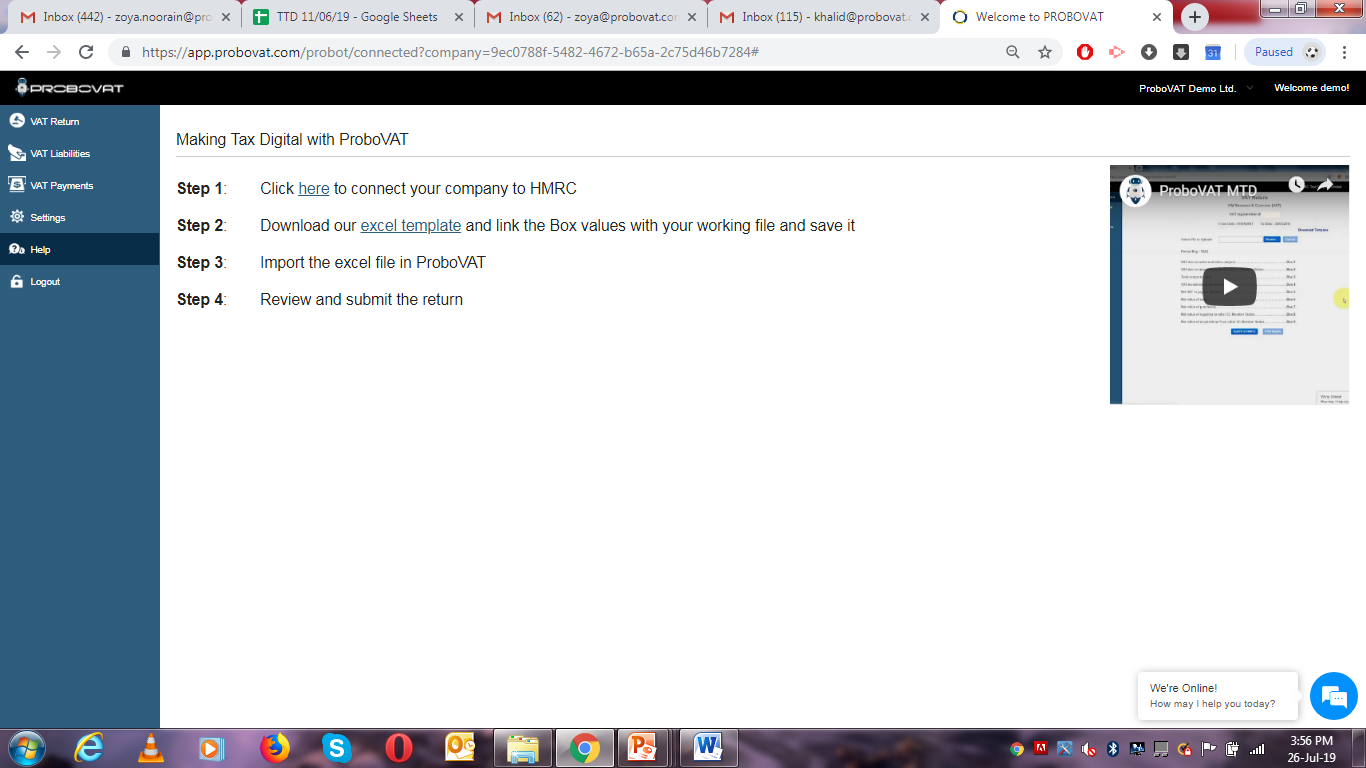

Step 4: After adding Company “ProboVAT’s Home page” will be displayed. Follow the steps mentioned in the screenshot

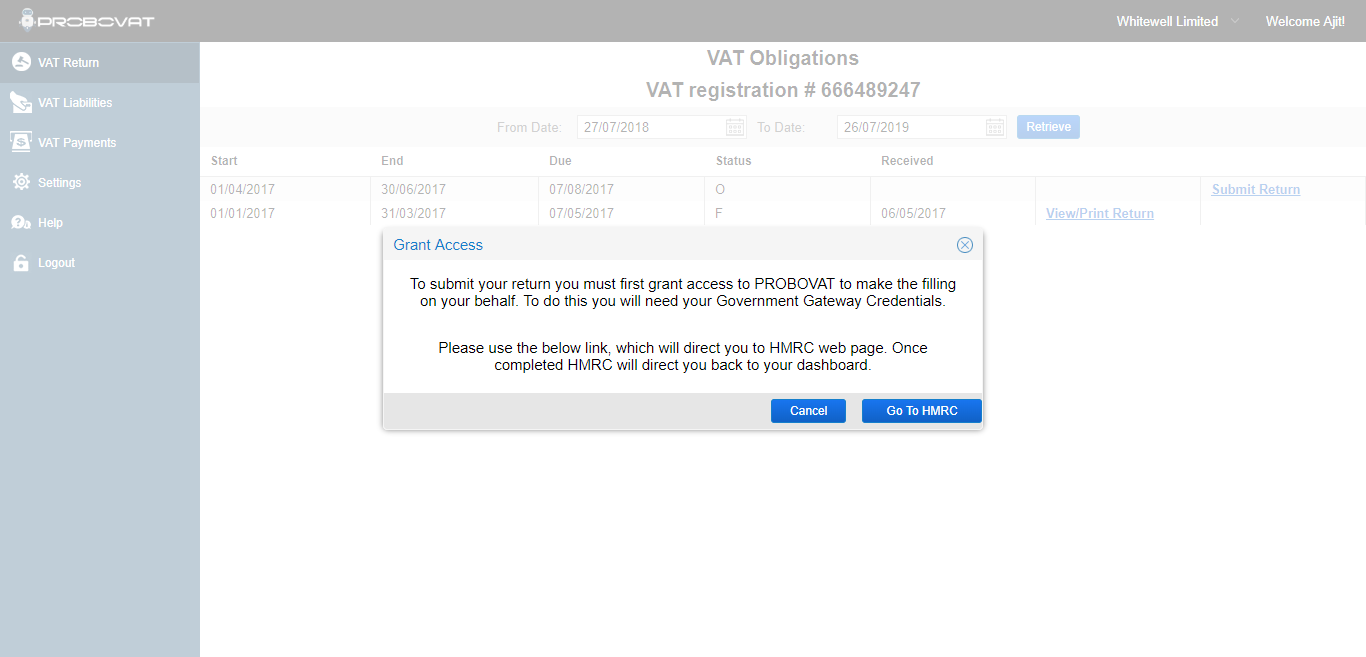

Step 5: Click on “VAT Return”. If it is not authorized with HMRC it will ask for access by displaying a window Grant Access, click on “Go To HMRC“ button.

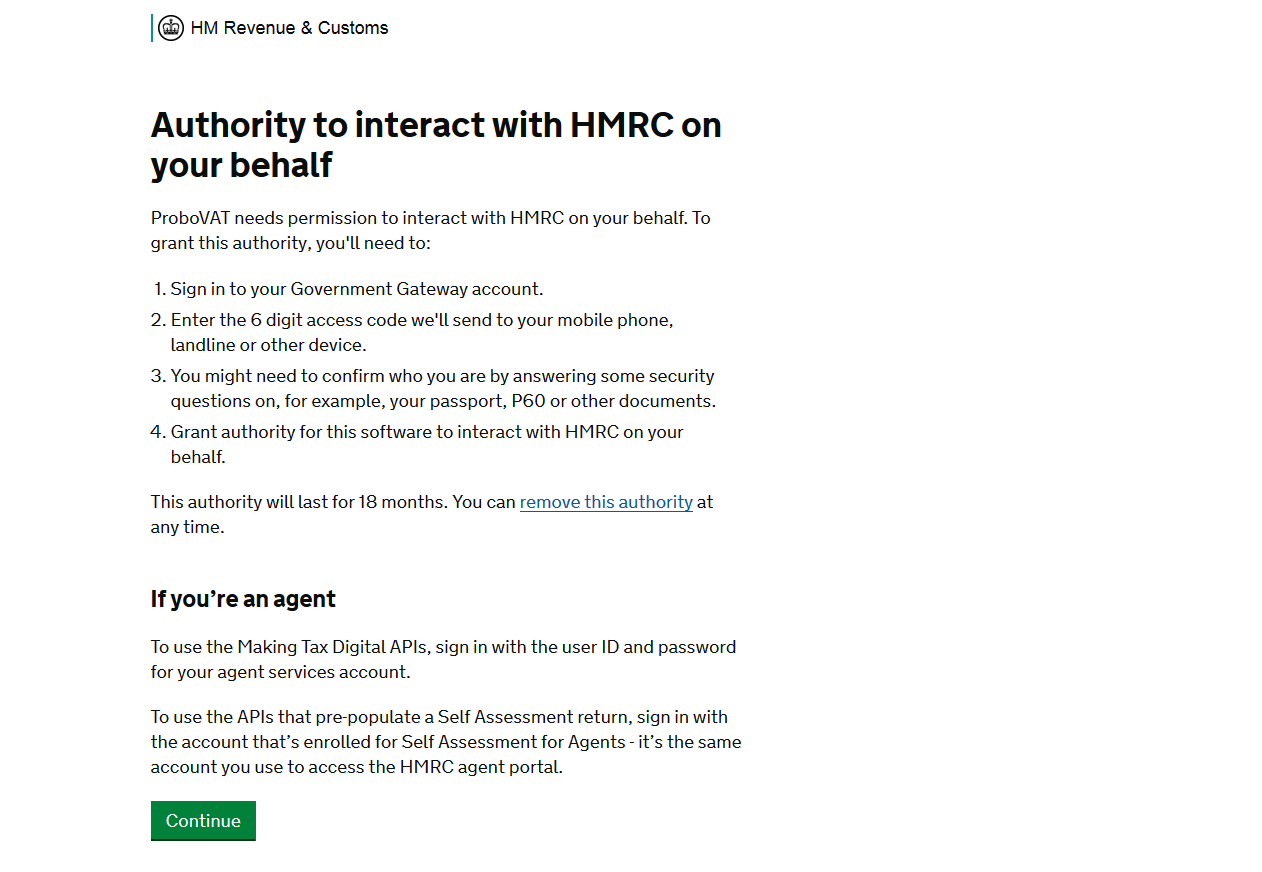

Step 6: Click on “Continue” button.

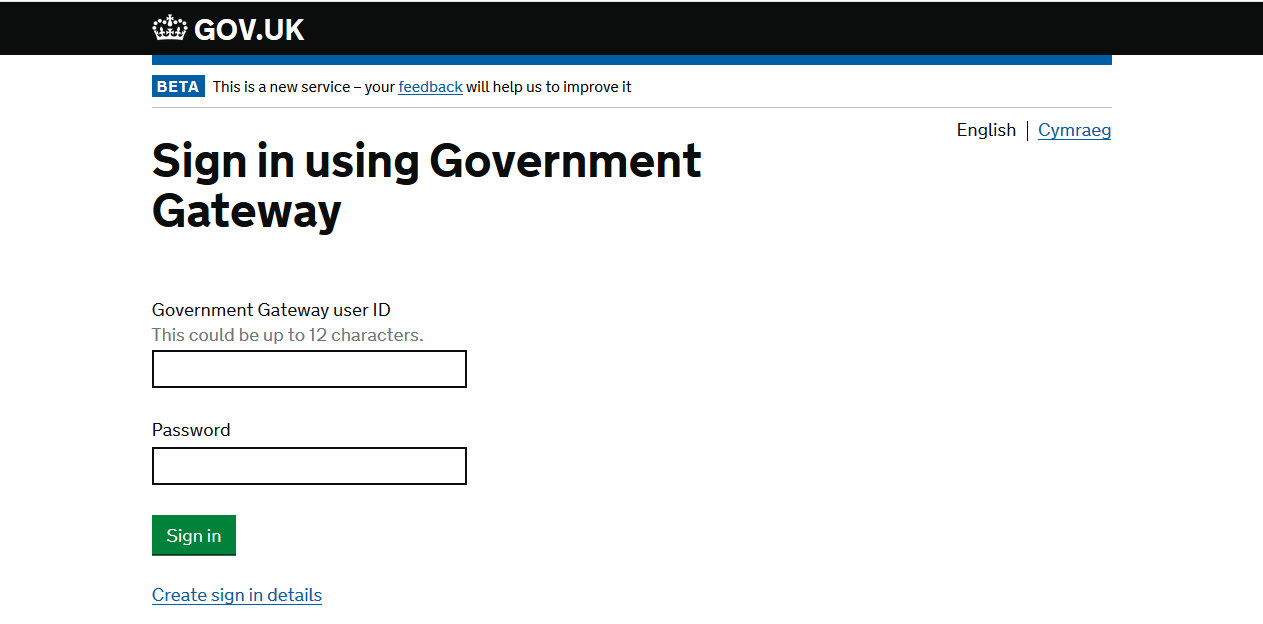

Step 7: Sign in by entering the HMRC Government Gateway User ID and Password

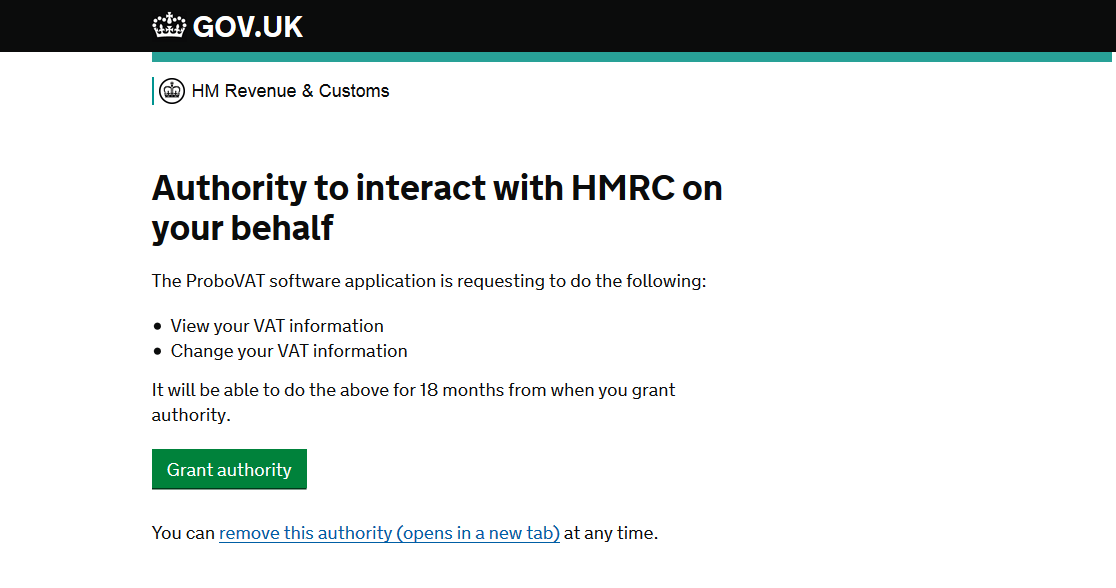

Step 8: Click on “Grant authority” button

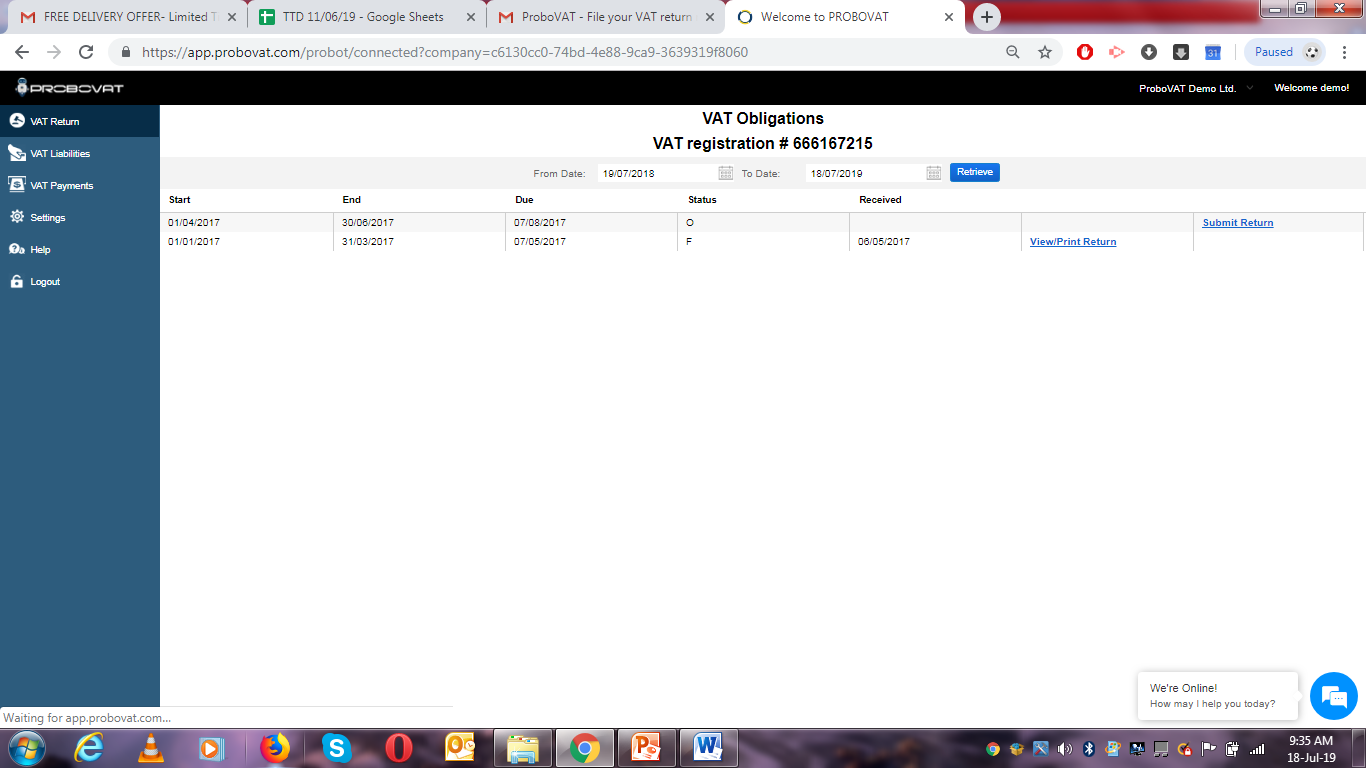

Step 9: VAT Return will be displayed for the period of one year. Click on “Submit Return” button in the last column of open obligation row.

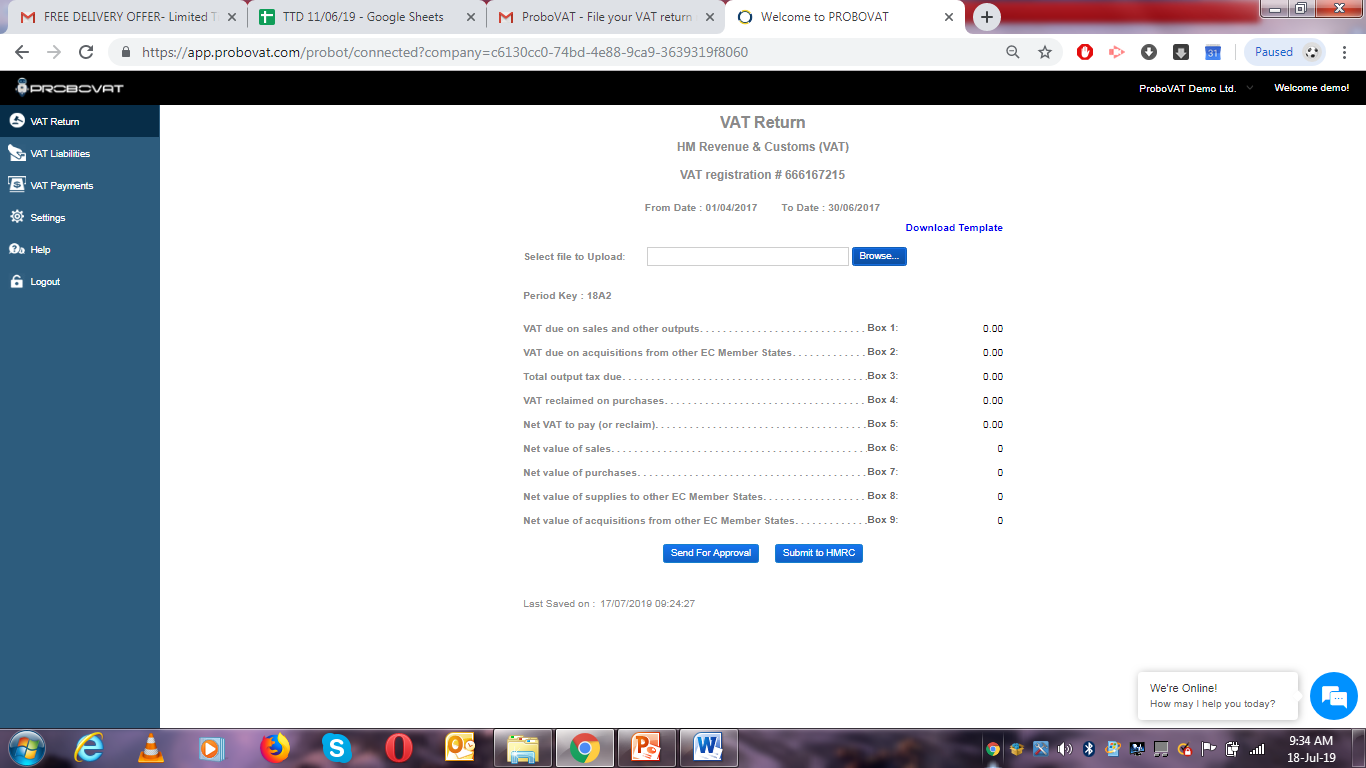

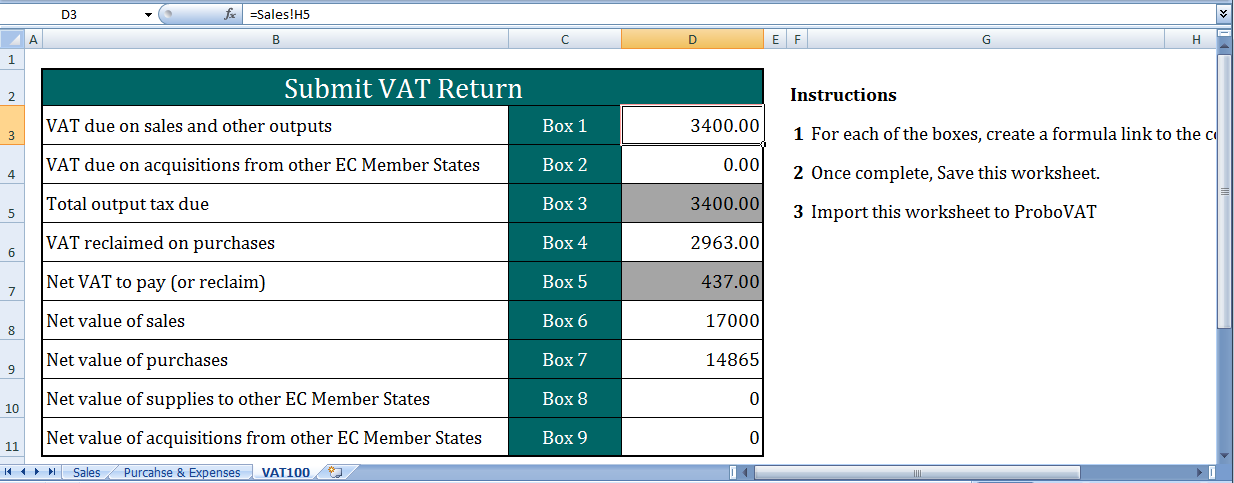

Step 10: Click on “Download Template” button to get the Submit return Form.

Step 11: Link VAT Workings with the ProboVAT Template Boxes and save file.

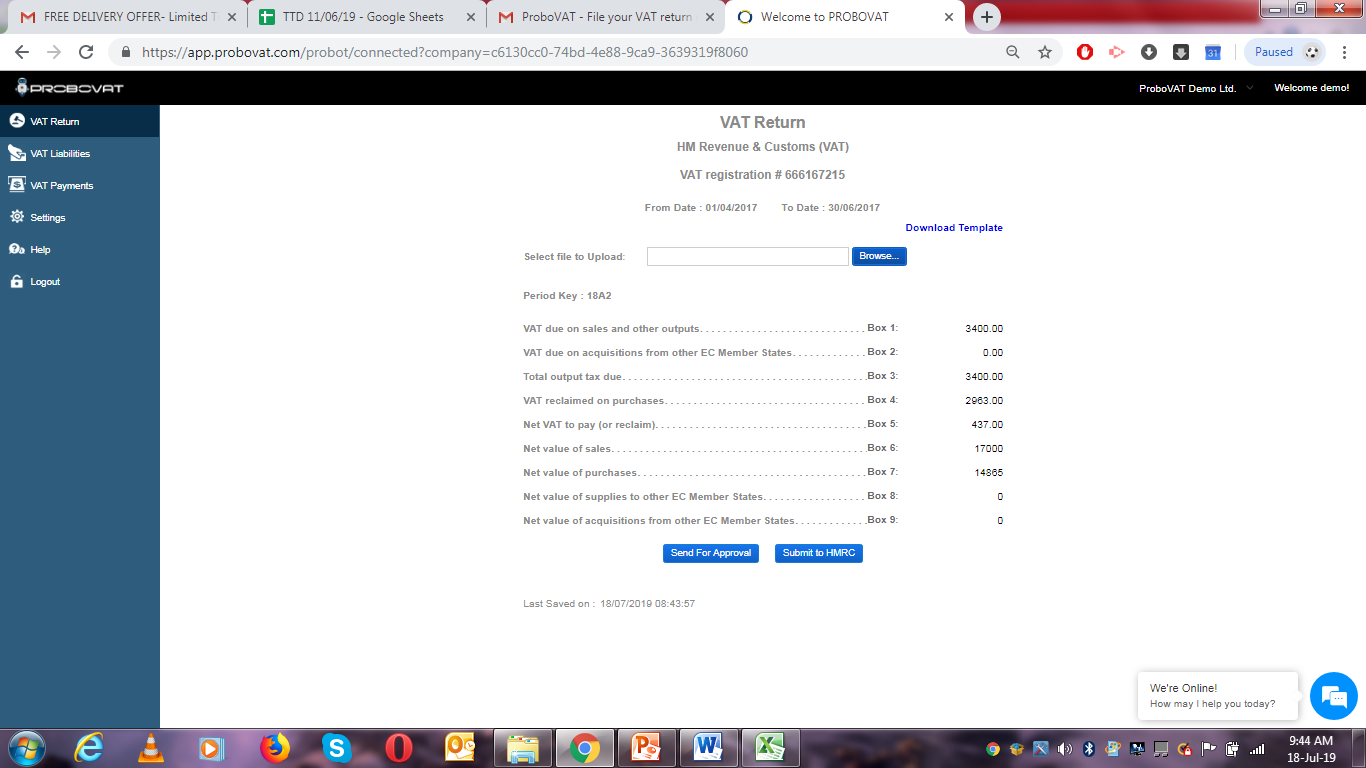

Step 12: Click on “Browse” option to browse and upload saved ProboVAT Template and click on the button “Submit to HMRC”.

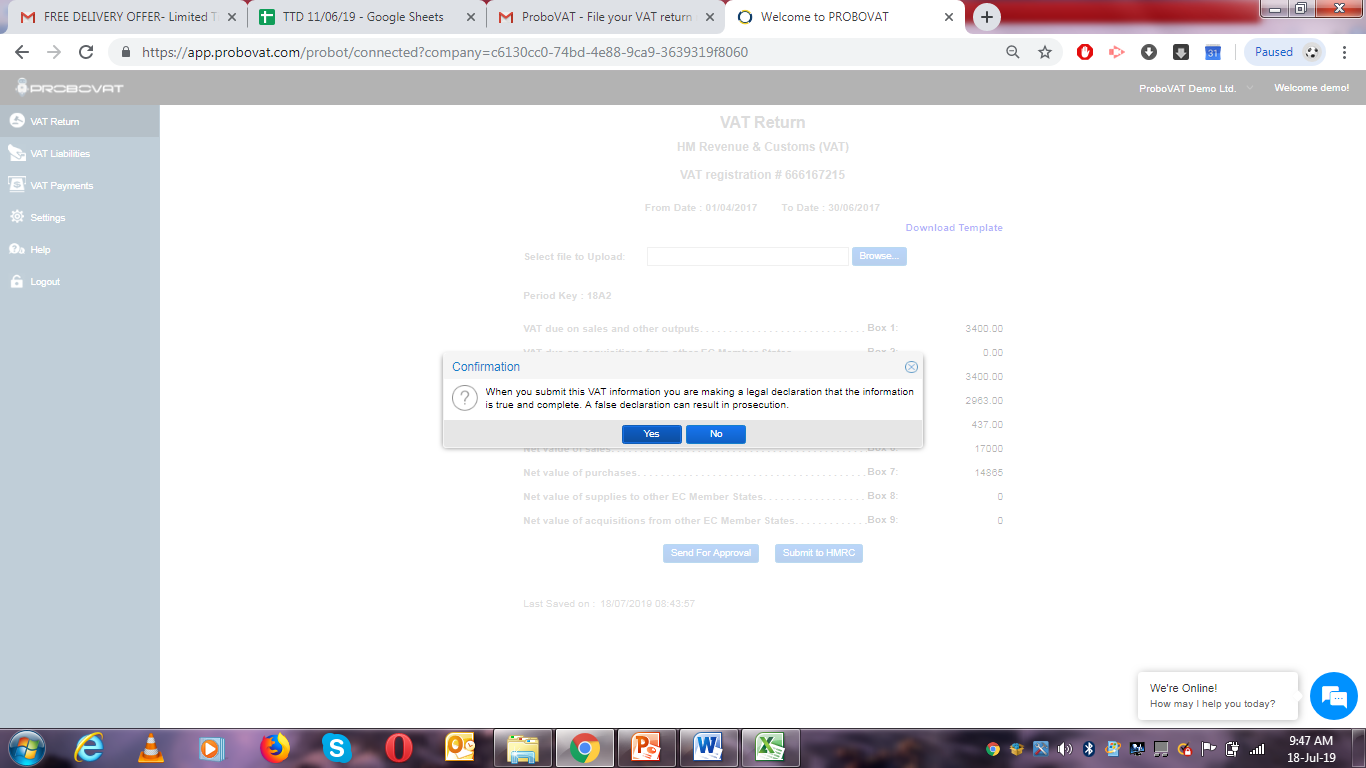

Step 13: Click on “Yes” to accept the declaration.

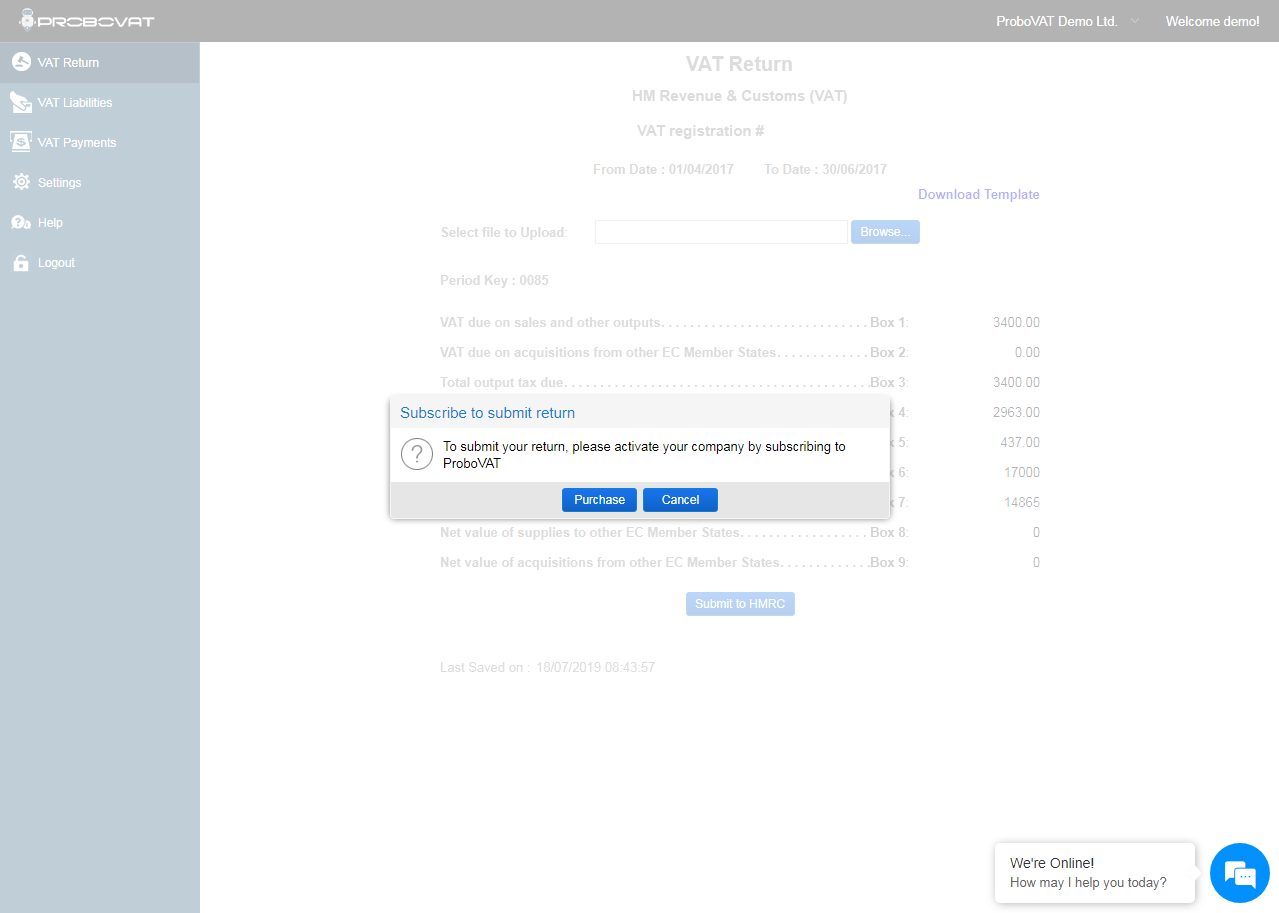

Step 14: The “Subscribe to submit return” message window will be displayed. You can click on the “Purchase” option and subscribe the plan for 1 year.

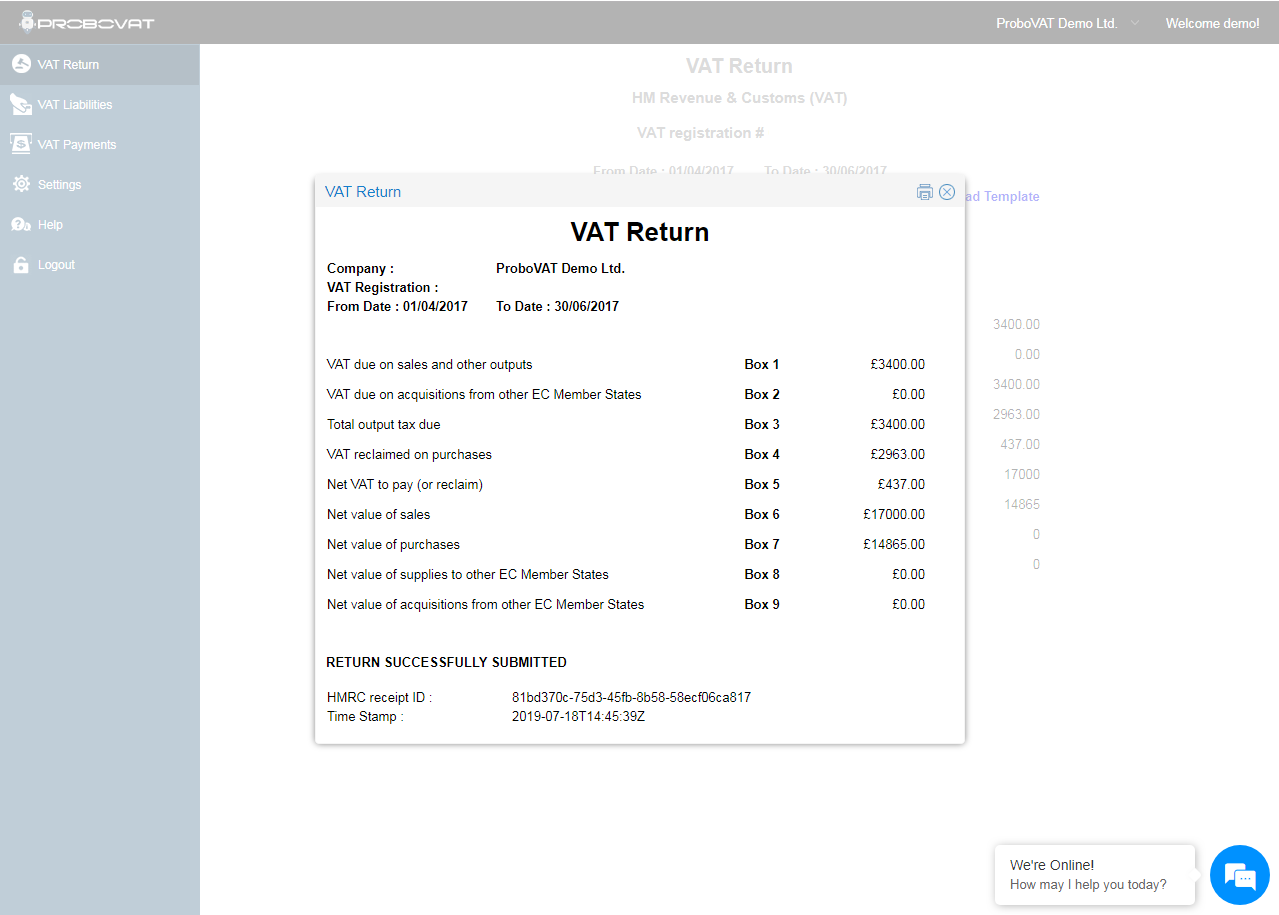

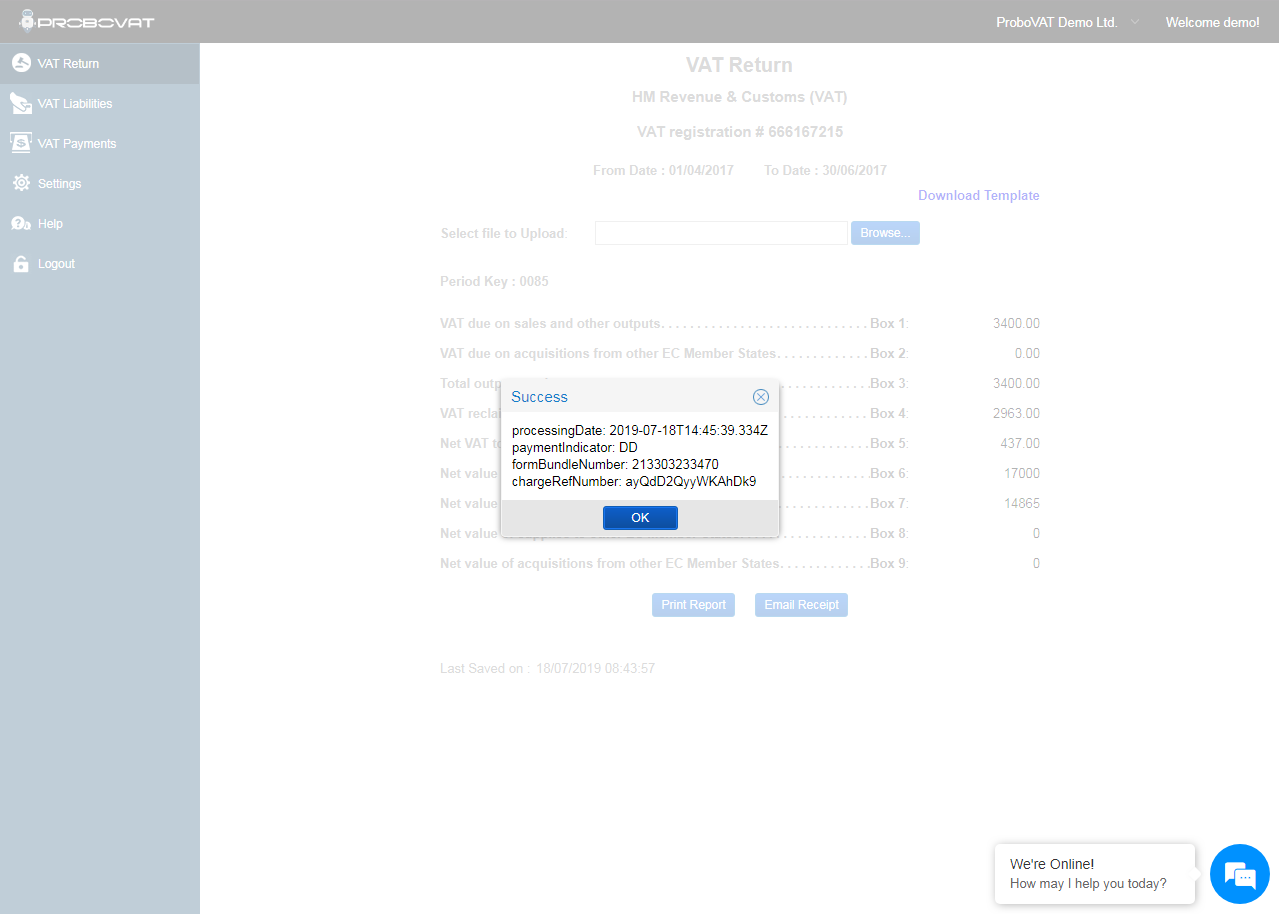

Step 15: The “Success” confirmation message window will be displayed along with HMRC receipt ID.

Step 16: User can print the Submitted VAT Return by clicking on the “Print” icon.